Pink Diamond Statistics

WANT TO KNOW HOW MUCH

YOUR PINK DIAMOND IS WORTH?

Pink diamond price calculator

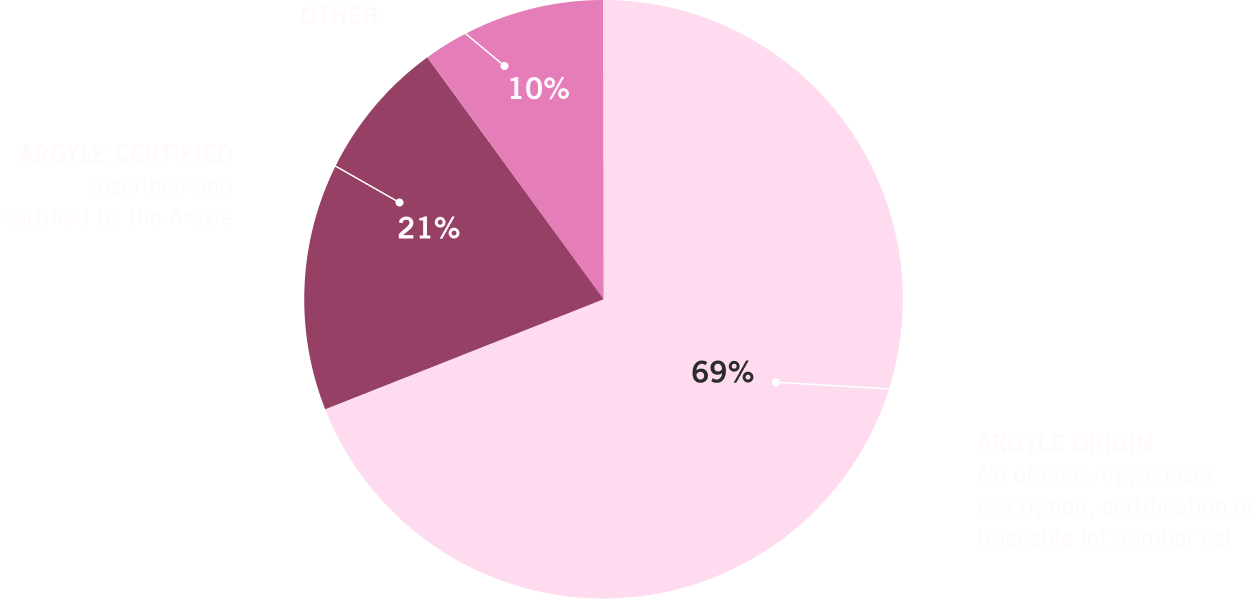

PINK DIAMOND DISTRIBUTION

Pink diamonds are systematically classified into three distinct categories: Argyle origin, Argyle certified, and pink diamonds from other geographical locations. Each of these classifications has significant importance in determining their value.

Total pink diamond distribution from

1984 to 2023

Argyle Certified – Inscribed and certificated by the Argyle (APD)

From January 2005 to December 2008, all Pink Diamonds from the Argyle mine weighing over 0.20ct were laser-inscribed and issued a certificate. In January 2009, this was lowered to 0.15ct. It was again reduced in December 2016 to include diamonds weighing 0.08ct to 0.14ct.

Argyle Origin – No official Argyle laser inscription, certification, or traceable lot number

All pink diamonds from the Argle mine were uninscribed from 1985 to 2005, except for a percentage of tender diamonds. In Antwerp Belgium, from 1985 to 2020 the Argyle Mine also consistently sold Pink, Purplish Pink, and Brownish industrial grade pink diamonds via an auction-based sales channel. None of these pink diamonds were ever cut, graded, laser inscribed or certified by the Argyle mine.

Other – Not from the Argyle mine

Pink diamonds can be found in various parts of the world, including Brazil, Canada, India, Russia, and Africa. Each region has its own unique characteristics that contribute to the formation and availability of these rare gemstones.

Pink Diamond Price Growth 2023

2005 to 2023 Annual Price Index

0.20ct | Round | P1 | Purpulish Pink

2005 to 2023 Annual Price Index

0.20ct | Round | P1 | Pink

2005 to 2023 Annual Price Index

0.20ct | Round | P1 | Pink Rose

Argyle certified pink diamond Price Index, Australian Diamond Analytics, NSW Australia, September 2023

Fancy Colour Diamond Price Index

Fancy Colour Research Foundation

2005-2023 Average Annual Growth

ALL SIZES, ORIGINS, AND INTENSITIES, IN PINK, BLUE AND YELLOW

New York, May 4, 2023: Q1 2023 FCRF Fancy Colour Diamond Index Results.

Since the inception of the Fancy Colour Research Foundation, there has been a notable appreciation in the value of all Fancy Colour Diamonds, resulting in an overall increase of 211%. Pink diamonds across all origins, shapes, sizes and colour intensities have witnessed the most significant gains of 396%, while yellow diamonds have seen a notable 58% increase and blue diamonds a respective 251% upsurge.

The Fancy Colour Research Foundation (FCRF) offers evidence-based assistance in comprehending Fancy Colour Diamonds as a viable asset class. The Fancy Colour Research Foundation (FCRF) is a non-trading organisation dedicated to promoting transparency and fair trade within the diamond industry. This is achieved through the utilisation of the Fancy Colour Diamond Price Index, which incorporates comprehensive data on rarity, auction analyses, commercial research, and objective valuations.

Pink Diamond Price Chart

The Australian Diamond Analytics price index serves as an evidence-based statistical instrument used to forecast the financial value and growth of a pink diamond from the Argyle mine. The system evaluates the market trends, international auction results, and sales data of more than 50,000 pink diamonds dating back to 2005.

argyle certified 0.08ct plus

2005 – 2023 Average annual growth

argyle certified 0.04ct to 0.7ct

2005 – 2023 Average annual growth

Argyle certified pink diamond Price Index, Australian Diamond Analytics, NSW Australia, September 2023

WANT TO KNOW HOW MUCH

YOUR PINK DIAMOND IS WORTH?

PINK DIAMOND PRICE CALCULATOR

VIP CONCIERGE SERVICE

The VIP concierge service is a personalised assistance and support facility that is dedicated to meeting the unique needs and preferences of our valued clients. These services include providing statistical diamond analytics and curated recommendations tailored to your individual preferences and financial goals.

Contact us today

Annette Svetec

General Manager

Annette began working in the Australian Pink Diamond industry after an extensive career as an executive for some of the world’s largest fashion houses, including Chanel, Christian Dior, Yves Saint Laurent and Guerlain.

Annette has been able to utilise her expertise and knowledge from the luxury brand industry to better assist her clients to achieve their financial goals.

Annette specialises in selecting & curating high return pink diamond investment portfolios for both entry-level and high-end investors.